All CMOs understand the power of branding, yet time and time again, they struggle to convince their peers to invest in it.

Most marketing leaders face pressure from non-marketing leaders who focus on the short-run effect and are impatient for the long-run impact of marketing spending.

That focus is understandable. Only 3% of CMOs can track brand health on an annual basis, according to Harvard Business Review.

If we assume the study is representative, 97% cannot demonstrate the value of long-term brand efforts. So, it’s from no fault of non-marketers, that they continue to see money spent on branding as an expense instead of an investment.

To clarify the power of branding, marketing leaders often highlight the “the long and the short of it” or the optimal 46/54-split between branding and sales activation in B2B to maximize sales uplift.

And while there is consensus in the marketing community that the findings are relevant, they don’t

persuade colleagues outside of marketing. It’s generic and should only be used as a primer, not as the “reason to believe in branding”.

Because there is more to branding than sales uplift.

Here are Kvadrant Consulting’s thoughts and arguments on how branding empowers the B2B organization, which marketing leaders are welcome to use to nuance their discussion around the importance of branding with their peers:

- Contribute to the enterprise valuation in the balance sheet

- Hire and keep qualified talent

- Increase bargaining power

- Easier to prospect

- Close more deals

- Win new markets

- Diversify into new categories

Argument 1: Contribute to the enterprise valuation in the balance sheet

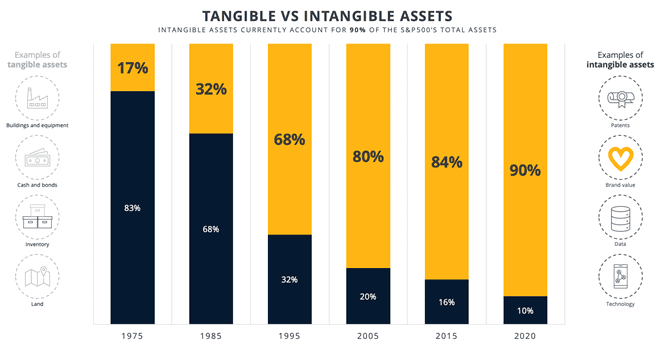

Since 1975, the value of intangible assets has soared S&P 500 (the 500 large companies listed on stock exchanges in the US).

Where intangible assets made up 17% of corporate valuation in 1975 – 35 years later, it represents 90%.

While technology and data are taking the lead within intangible assets and capturing a larger share of the valuation, brand equity contributes to this development in B2B, according to Lambkin and Muzellec.

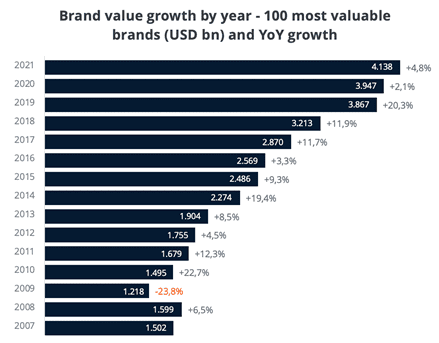

Not only is the brand value capturing a larger share, but the YoY growth of the top 100 most valuable brands also continues to increase.

Branding helps drive a higher company valuation

Argument 2: Hire and keep qualified talent

Branding does more than add asset value to the balance sheet – it provides a platform that benefits the HR department’s daily work.

Most HR organizations face three common challenges:

- Recruit talent: HR spends a lot of time and money recruiting the right talent through job ads, screening, interviews, tests, etc.

- Motivate talent: Costs related to commissions or annual to maintain or improve performance

- Keep talent: Expenditures related to keeping high-performing talent that are in the search spotlight for a longer time

These challenges exist in many B2B organizations, and their ways of handling these are based on a commodified approach. They are usually present when the company’s brand is weak or non-existent.

Employer branding offers a way to address the three challenges of recruitment, motivation, and retention by utilizing the brand equity to current and potential employees:

- Recruit talent: Hiring costs decrease by 23% when candidates proactively apply and want to work for the company (LinkedIn)

- Motivate talent: Purposeful brands are 22% less likely to give financial incentives to improve performance (Glassdoor)

- Keep talent: Brand leaders reduce employee turnover by up to 28% compared to laggards (LinkedIn)

But it’s important to recognize that a strong employer branding platform can only be as strong as the company’s brand itself.

HR should, or must, use the brand as the foundation to make employer branding as relevant, coherent, and consistent as possible.

With a strong employer brand, HR organizations will experience more qualified candidates during recruitment, fewer resources needed to motivate and keep talented colleagues – all because they like and believe in the company they work for.

The results are better, harder-working, long-tenured, and lower-paid employees easier to hire.

Branding helps the HR department become more successful

Argument 3: Increase bargaining power

While the primary target audience of building a strong brand are buyers and end-users, brand building fundamentally also creates a pull and preference from suppliers further up the value chain.

For example, it is unlikely that suppliers will go the extra mile to partner with an unknown or weak brand. Why would they? Suppliers want to ensure their hitting their sales quotas as well.

Without a strong brand, the deal size and procurement’s negotiation skills will be the only factors influencing price.

But with a strong brand, the procurement department has a larger negotiation power and can walk away with more favorable contracts, better payment terms, additional deliveries, etc.

Because suppliers get something in return, they become associated with the brand (and can get the brand logo, case, and reference story on their website).

Branding helps procurement engage and negotiate with upstream suppliers

Argument 4: Easier to prospect in existing markets

On average, a strong B2B brand outperforms weak brands by 20 %, according to McKinsey & Company, who studied several industries, including IT, logistics, manufacturing, telecoms, and utilities.

As sales look for more qualified leads, driving low-funnel activities is not the only solution to help sellers sell more. The correlation between brand strength and seller performance is statistically significant.

When selling offerings from a strong brand, salespeople are better positioned to express value, differentiate from the competition, and fight price pressure, from prospecting to closing:

When prospecting:

- Customers more attuned to engage in dialogue

- Easier access to strategic stakeholders

- Increased ability to customize propositions

- Higher conversion rate from meeting to opportunity

- Automatic qualification to RFI/RFPs

- Shorter sales cycles, due to less vetting

While branding helps sellers sell more effectively and efficiently, let’s dive deeper into “closing” in the next section.

Argument 5: Close more deals

While B2B buyers are more unbiased and rational than consumers, we have yet to see a B2B buyer operate only in an objective vacuum.

And while data-driven decision-making is the bedrock for B2B decision making, branding can influence the “softer” factors that can’t be put in an Excel sheet.

Imagine you are part of a buying committee of a new CRM platform.

After a long research process, with lots of back and forth with different colleagues across the organization, you and the rest of the buying committee have identified the core challenge, explored potential platforms, and built requirements for the business case.

The committee is now faced with two potential suppliers on the shortlist: an unknown supplier and a supplier with a strong brand.

To strengthen the argument, let us assume that the unknown supplier lives up to all the requirements set by the business case, while the branded supplier doesn’t. Somehow, the unknown supplier seems to have the perfect CRM to solve all your organization’s challenges.

Obviously, the right choice is to select the unknown platform. But there is a reason why the saying goes: “Nobody gets fired for buying IBM.”

The saying taps into that B2B buyers are risk-averse. Especially when an investment is high, and the product is complex, just like a CRM platform.

If the committee buys the unknown platform, they risk being in the firing line if the entire CRM breaks down.

The branded platform is the safe purchase in this part of the buying situation. And if a problem occurs, it would come more as a surprise and be such an irregularity that no one could predict it.

And buyers would have peace of mind knowing that they are not to blame.

The risk of doing something wrong outweighs the potential of something right.

It is a shame because it denies innovative competitors who may do a better job. But that is how the corporate world works.

Branding reduces buyers’ perceived risk late in the buyer journey.

Argument 6: Win new markets

The strategic objective or motivation behind expanding the value chain, entering new markets, or new customer segments varies greatly.

Regardless of what that may be, when you set up base camp in no-man’s land, risks are high, and the chance of converting uncharted territory to promise land is low.

Because if companies have not planted the seed before engaging in new segments or markets, they are putting themselves up to failure and cannot expect market success, especially if they purely rely on sales incentives in the short term.

With a strong brand, companies can expand within the value chain more easily as stakeholders identify the company, its solutions, and its capabilities. And when expanding geographically into new markets, brands get easier access to local channels and relevant partners who want to engage with the brand.

Without the brand, salespeople prospecting in uncharted territories will have little to no responses to their calls, e-mails, and meeting proposals because no one has heard of the company. It isn’t easy to see, but branding helps salespeople reach their quotas.

Branding helps the company enter new markets or segments.

Beyond new markets, branding also helps B2B companies diversify into new categories as well:

Argument 7: Diversify into new categories

When asked what Hewlett Packard (HP) offers, most answer laptops and desktop computers. And that is true, but when Bill Hewlett and David Packard founded HP, their first offering was audio oscillators, in other words, test sound equipment.

HP doesn’t offer oscillators anymore, as the category is long gone. At some point, every product category begins to mature, dry up, and slowly disappear. Brands that dominate one specific category risks a decreasing topline if they don’t keep an eye out for diversification opportunities in the long run.

That is the role of brand extensions: A brand can venture into new, smaller categories, which down the road can become a lifeline to secure significant revenue – potentially bigger than the original business ever had generated.

After all, HP makes more business selling computers in a week than it ever did selling test sound equipment.

Branding allows companies to live forever.

Impact across the enterprise

Most functions have objectives that create a very clear impact:

- The CEO & CFO’s objective is to maximize the value of the company

- Corporate strategy’s objective is to identify new markets and segments to target

- Sales’ objective is to generate revenue

- HR’s objective is to hire and keep talent

- Procurement’s objective is to minimize costs related to supplier deals

And the takeaway is clear: Every time you invest one dollar in branding; you invest across the enterprise.

Let’s be crystal clear. Branding doesn’t solve business functions’ challenges or deliver the needed solution to reach their objective(s).

But a strong brand empowers them and helps them along the way.

When CMOs have demonstrated the hidden power of branding to their peers, we hope it’ll be perceived more as an investment, not an expense – allowing more control of allocating marketing resources in the right places.

Current business performance in the long-term:

- Increase company valuation

- Recruit and maintain more qualified, harder working, lower-paid talent

- Easier to sell in existing markets

- Reduce risk in the late stage of the buyer journey

- Create supplier preference earlier in the value chain

New endeavors in the future:

- Make it easier to reach new markets and segments

- Diversify into new categories